AI in Banking: Don’t Fall Behind in the 2025 FinTech Race

Banking is changing fast, and artificial intelligence (AI) is leading the way. AI banking apps will transform how we handle money, communicate with banks, and make financial decisions by 2025. Whether you’re into technology, learning to code, or working in banking, knowing the latest trends, challenges, and opportunities in AI-driven banking is important.

In this blog, we’ll take a look at the future of AI in banking, share real-world examples, and give practical tips for beginners who want to get started in this growing field. We’ll also talk about common mistakes and how to avoid them so you can confidently step into the world of AI banking. Let’s get started!

An AI Banking Mobile App is a financial application that leverages Artificial Intelligence (AI) to provide users with personalized, automated, and secure banking services. These apps integrate AI-powered technologies such as machine learning (ML), natural language processing (NLP), predictive analytics, and robotic process automation (RPA) to enhance user experience, optimize financial management, and improve security.

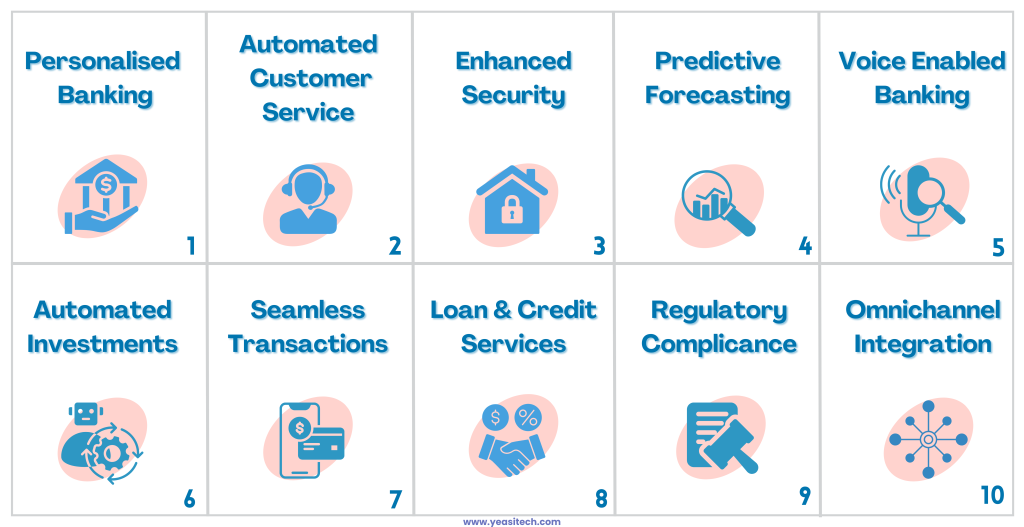

AI-powered banking apps offer advanced features that improve user experience, security, and financial management. Here are some key features:

Here’s a comparison table between an AI-Powered Banking App and a Ready-Made Banking App so that you can get a clearer picture:

| Feature | AI-Powered Banking App | Ready-Made Banking App |

| Customization | Highly customizable with AI-driven insights and automation. | Limited customization based on pre-built templates. |

| User Experience | Personalized services using AI for recommendations and fraud detection. | Standard user experience with fixed features. |

| Automation | AI automates transactions, customer support (chatbots), and fraud detection. | Basic automation, mostly rule-based. |

| Security | Advanced AI-based fraud detection, biometric authentication, and real-time risk analysis. | Standard security protocols without AI-driven detection. |

| Cost | Standard features are available to all competitors. | More affordable with one-time or subscription-based pricing. |

| Implementation Time | Longer development time due to AI model training and customization. | Quick deployment as it comes pre-built. |

| Scalability | Easily scalable with AI improving as data grows. | Limited scalability due to fixed architecture. |

| Predictive Analytics | AI analyzes spending patterns and provides financial insights. | Basic analytics with fixed reports. |

| Customer Support | AI-powered chatbots for 24/7 instant responses. | Manual or limited automated responses. |

| Regulatory Compliance | Can be programmed to adapt dynamically to changing regulations. | Compliance updates require manual intervention. |

| Integration | Can integrate with multiple financial services using AI APIs. | Limited third-party integrations. |

| Competitive Edge | Provides innovative banking experiences through AI-driven insights. | It can be programmed to adapt dynamically to changing regulations. |

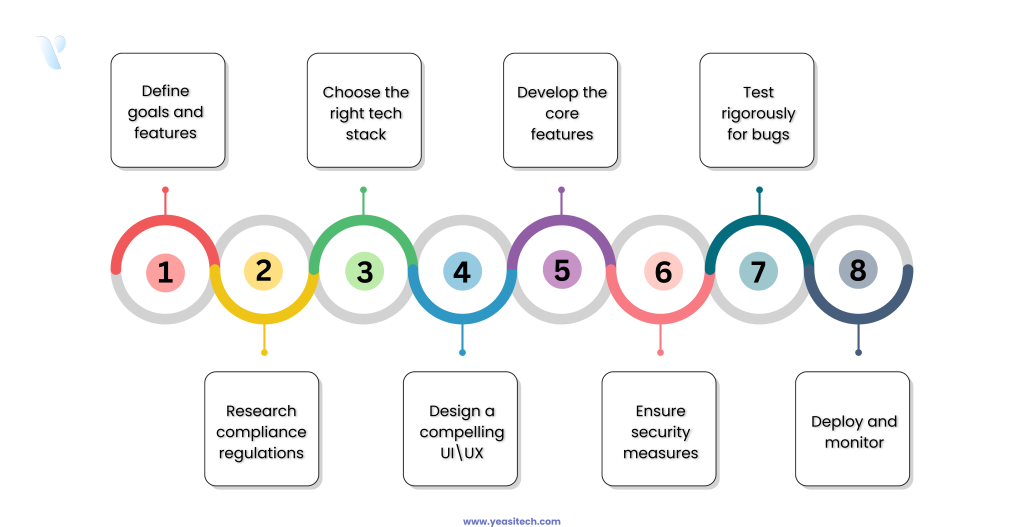

Careful planning, security precautions, and innovative AI skills are necessary when developing a banking app that uses AI. Use these simple methods to make your vision a reality!

Before diving into development, decide what you want your AI banking app to do. Some key features include:

Banking apps must follow strict regulations like:

Your app needs a solid foundation. Here’s a tech stack recommendation:

Users should feel comfortable navigating your app. Follow these UI/UX principles:

Start by coding the most critical functionalities:

Banking apps must be highly secure! Implement:

No one likes a buggy app! Perform:

Once tested, launch your app on the App Store and Google Play. But your work doesn’t stop there!

Keep improving! Introduce robo-advisors, crypto banking, or even voice-activated banking for the future.

And that’s it! You now have a roadmap to developing a powerful AI banking app. Yet confused regarding the steps? Book a free session with our Experts and get expert advice for free.

Developing financial software with AI sounds interesting, but there are obstacles to overcome. The good news? Every challenge has a solution! Let’s explore them in a simple and engaging way:

Problem:

Because AI banking apps manage private user information, hackers are particularly interested in them. Financial losses and a decline in client trust could result from a security breach.

Solution:

Challenge:

Financial institutions must comply with KYC, AML, and GDPR regulations. Failing to meet these regulations can lead to legal troubles.

Solution:

Challenge:

AI systems can learn from historical data, but if that data is biased the AI may make unjust judgments, such as randomly refusing loans to particular users.

Solution:

Challenge:

Many users hesitate to trust AI to handle their money. If the app is too complex, they might abandon it.

Solution:

Challenge:

AI integration, security measures, and compliance requirements can make development expensive.

Solution:

Want to know more about MVP? Check our blog on Why MVP Development is Crucial and get valuable insight.

Challenge:

As more users join the app, AI features like fraud detection and chatbots may slow down, leading to poor user experience.

Solution:

Artificial Intelligence (AI) is transforming banking, making it faster, smarter, and more secure. Let’s explore some of the most successful AI banking apps and their impact:

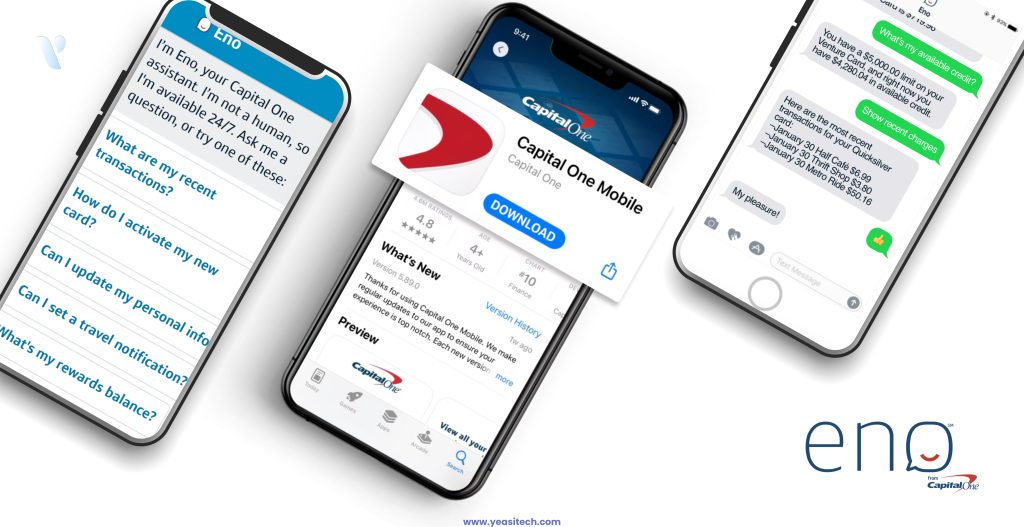

Eno monitors transactions, alerts users to potential fraud, and generates virtual credit card numbers for safer online shopping. Its impact includes preventing thousands of fraud cases by identifying suspicious activity early. Eno provides real-time transaction updates and valuable account insights.

Result: Enhanced security and convenience for millions of Capital One users.

Cleo is a chatbot-based AI assistant designed to help users save money, budget more effectively, and even add a touch of humor by playfully roasting them for poor spending habits. Its smart savings feature has enabled users to save 30% more money, making financial management both efficient and engaging. Particularly popular among younger users, Cleo offers an interactive experience that not only improves financial literacy but also makes learning about money fun.

Result: Cleo makes banking more engaging, accessible, and rewarding for users.

The following figures are derived from the expertise of our software developers in developing similar AI Banking apps:

| Feature | Cost Estimation (Starter) |

| App Development | $1,000 |

| AI Chatbot | $500 (Basic) |

| Users | $500 (5,000 Users) |

| Security | $500 (Standard) |

| Banking Features | $500 (Payments) |

| UI/UX Design | $500 (Ready-to-Use) |

| Reports & Insights | $500 (Basic) |

| Support | $500 (Email) |

AI-powered banking is revolutionizing the financial industry, making transactions smarter, security stronger, and customer experiences more personalized. As AI-driven solutions continue to evolve, banks and fintech companies must stay ahead by adopting the latest technologies and ensuring compliance with regulations. Whether you’re a developer, a banker, or simply interested in the future of finance, understanding AI in banking will open new opportunities for growth and innovation.

At YeasiTech, we specialize in building AI-driven banking solutions that enhance security, automate financial processes, and improve customer experiences.

Ready to develop your own AI banking app? Contact us today for expert guidance and bring your vision to life!

AI banking apps use artificial intelligence to provide personalized financial services, automate transactions, detect fraud, and improve customer support through chatbots and predictive analytics.

These apps use advanced encryption, biometric authentication, and AI-powered fraud detection to protect users’ data and prevent unauthorized access.

Yes! AI-powered apps analyze your spending habits, offer budgeting insights, and provide automated savings suggestions to help you manage your finances better.

While AI chatbots handle basic inquiries 24/7, human representatives are still available for complex issues, ensuring a balance between efficiency and personalized support.

Many banks offer AI-powered features for free, but some advanced tools or premium services may require a subscription or a higher-tier account.

YeasiTech is a trusted IT service partner with 8+ years of experience, empowering 250+ businesses with scalable web, mobile and AI solutions.

Explore related topics to broaden your understanding and gain actionable insights that can transform your strategies.